February 10, 2005

FROM: Dianne S. Gallets, Township Administrator

Budget surplus and tax rate history

Dear Township Committeemen,

I know you are all probably tired of hearing this, but I am again going to try and explain the current budget problem we are in. Yes, everybody has problems, but ours could have been easily avoided.

The Township has been budgeting, not the money, but the tax increase so that they can say that the increases are nominal every year for about five years. I don't think that in more than one year the tax increase even came close to reaching the "cost of living' during that period, and at the same time the raises, insurance expenses, and utilities were increasing faster than the "'cost of living". During that same time period, the schools increased their tax request by as much as 10% and in most cases the public voted for it. Last year when the Township's rate went up .4% the school's rate went up 8.5%. A history of the tax rate increase is attached.

Use of Surplus - In the past the Township has historically used more than 55% and less than 65% of its surplus to offset the tax rate. This is a conservative approach and had always worked in the past. In 1997 the Committee started to anticipate how much the surplus would increase (like using a slot machine) and using more in the current year. This has steadily increased to 2004 where the township used 86% of their savings to run the town. That also effects the interest we receive, because all of the surplus is invested and gains more interest (even though it is a small amount). We now have the same amount of surplus to use as we did in 1992 and instead of using 63%, we are anticipating using 92%. That means that next year, there will be even less and the problem will only get worse. A history of the surplus is attached.

Reserve for Uncollected Taxes - This is an amount which we must include in our budget in case people do not pay their taxes. It is based on a formula % of the total tax dollars for the year. This means that if the school and county taxes increase, our budget must increase to make up for any shortfall. If they show that they need $1,000,000 for the year, they get that amount, whether people pay their taxes or not. In 2001 we had included in our budget an amount of $1,697,581 for Reserve for Uncollected Taxes and in 2005 we are anticipating $1,910,000 for this line. (An increase of $265,000 over a 5 year period). It becomes difficult to try to keep a budget on track when the Township Committee's philosophy changes each year to accommodate requests and they do not look at the whole picture. Although when new developments come onto the tax roles the township receives the first portion as an extra, it cannot start assuming that this money will come in. It is nothing more than thinking you will hit the lottery next month and spending the money now.

Dollars vs. Percentage - Prior to about 5 years ago, the Township Committee discussed the amount of cents the rate would go up but then changed to percentages. An increase of I cent gives you about $166,000 in tax dollars. When the school goes up by ll cents (like last year) they get $1,826,000 more to work with for the year. Last year the Township rate went up by 1/2 cents which gave you $83,000 more to work with. (But you budgeted total expenditures of $1,069,000 more than the prior year, even when you only raised the rate to give you $83,000 more.) The schools use an 'average" house to be $266,000 and one cent increase on that home would be about $27.00 per year. (Less than one cup of coffee before work every morning for one month) Right now you are about 9 cents behind the 8 ball, and that is including an already built in increase of 2 cents. This budget is in big trouble .........

Thank you.

DSG/me

Enclosures

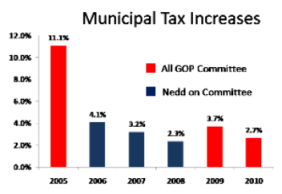

Bottom Line: The more you look at John Krickus' record, the more you realize he has no business running for Freeholder in Morris County!

No comments:

Post a Comment

To ensure this site remains a valuable service to our community, no anonymous posting is allowed.

Names will be verified (online Morris County Tax Records) prior to appearing on the blog. If you are not man or woman enough to sign your real name to a posting then you should probably keep your opinion to yourself.